What Really Sunk the Titanic?

It’s an iconic image in pop culture — Leonardo DiCaprio leans in close behind Kate Winslet as she raises her arms and exclaims, “I’m flying!”

But what can Kate and Leo teach us about risk management?

Quite a lot, in fact. Thanks to several movies and countless other retellings, the tragedy of the Titanic is something everyone knows about.

But what most people don’t realize is that the tragedy was caused by a failure to prepare for the unpredictable. So while the profession of risk manager may not be as familiar to you as doctor or lawyer, it’s just as important.

That’s how Michael Angelina, executive director of the Academy of Risk Management and Insurance at Saint Joseph's University, kicks off his intro to risk management courses. Because with a better understanding of some basic risk management principles, he says, the Titanic never would have sunk at all.

It turns out that some of history’s biggest disasters could have been averted—or their impact minimized—with better risk management. So take a closer look at these four disasters and see whether you have what it takes to plan better.

- The sinking of the Titanic

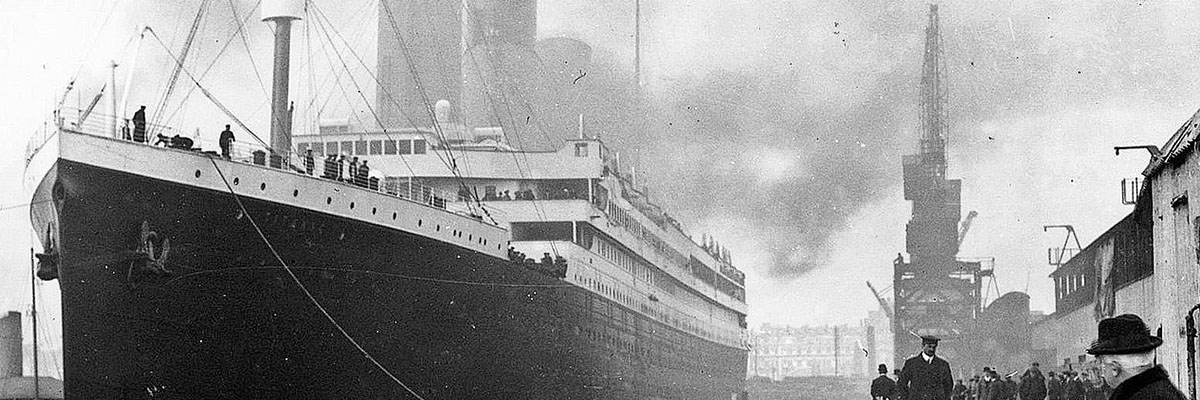

The shortage of lifeboats on board the Titanic on April 15, 1912, has become a well-known fact, reflecting the arrogance and naiveté of the designers, crewmembers and passengers who were positive that the massive vessel was unsinkable. To be sure, pretty much everyone was overconfident — for example, lookouts weren’t given binoculars, and warnings from other ships about icebergs in the area were ignored — then there’s the fact that the ship was traveling too fast at night.

And while the lack of lifeboats is held up as the primary example of that hubris, the 20 lifeboats actually exceeded safety regulations at the time. In fact, only 16 rescue ships were required. Lifeboat capacity was determined by the weight of the ship, not the number of passengers on board. This rule was developed for much smaller ships and hadn’t been updated to adjust for the enormous ships built in the early years of the 20th century.

What’s more, there hadn’t been a significant loss of life at sea for 40 years, and large ships usually stayed afloat long enough for individual lifeboats to make multiple trips to and from a rescue vessel. For all those reasons, everyone tragically assumed that there were an adequate number of lifeboats for passengers.

The lesson: Risk managers now look at risk quite differently. They know that simply complying with regulations and established best practices is no guarantee that a specific risk has been effectively mitigated. It’s a risk manager’s job to look beyond what’s required to determine whether additional action must be taken to keep people out of harm’s way.

- Deepwater Horizon explosion

When the Deepwater Horizon oil rig exploded on April 20, 2010, several executives from BP and Transocean were actually on the structure to celebrate seven years without a lost-time safety incident. Company leaders were so focused on preventing—and measuring—lesser risks like slips, trips and falls that they failed to identify the more complicated process-management risks that ultimately led to the explosion.

The lesson: A big part of a risk manager’s job is to perform risk analyses, which essentially weigh the likelihood of something happening against its potential impact, then identify ways to address or mitigate those risks. Thanks to complacency, corner cutting, arrogance, or some combination of those factors and others, BP and Transocean targeted risks with high probabilities and low impact. In the process, they neglected risks in the opposite quadrant of that matrix, which were unlikely to occur but could have catastrophic results.

- September 11 attacks

Since the tragic events of September 11, 2001, individuals, businesses and the United States government have put vast efforts and resources into preparing for and defending our nation against future attacks. Professors of risk management at the University of Pennsylvania call the attacks of September 11 a “black swan” event—one that is very rare and difficult to prepare for.

Risk managers are very good at preventing what’s happened before from happening again. But some events are extremely difficult to predict. Before September 11, 2001, terrorism was listed as an unnamed peril in a majority of commercial insurance policies, according to Penn researchers. After the attacks, insurers paid $23 billion, and many states passed laws permitting insurers to exclude terrorism from corporate policies. Today, the semipublic Terrorism Risk Insurance Program Reauthorization Act of 2015 covers up to $100 billion in insured losses caused by terrorist attack.

The lesson: These black swan events are difficult to predict and even more difficult to prepare for. Sadly, although risk managers do all they can to predict future catastrophes, some aspects of risk management will always be limited to reacting to the specifics of previous significant events and incorporating them into the models they use to forecast future risk.

- Financial Crisis of 2007–08

Plenty of people were quick to blame risk managers for failing to protect the world’s largest financial institutions against the biggest economic disaster since the Great Depression. The Harvard Business Review identified six ways companies fail to manage risk, while the Risk and Insurance Management Society (RIMS) argues that the financial crisis was caused not by the failure of risk management but by organizations’ failure to embrace appropriate enterprise risk management behaviors. Companies provided short-term incentives and did not communicate enterprise risk management principles to all levels of the organization, leading to a big crisis when companies took bigger risks than they could stomach in a big downturn.

The lesson: Risk management cannot exist in a vacuum. The best risk managers don’t sit in an enclosed silo, they work with all levels of the organization, help create a culture and incentive system appropriate to the level of risk, and — more than anything else — they make sure that they know what external risks outside their control could cause issues.

The question still remains: Would the Titanic have stayed afloat with better risk management? We’ll never know, but we do know that risk managers aren’t there to be naysayers. They exist to help protect companies, people and the world at large from taking on potentially devastating risks. If you’re considering a career in risk management, you could be the one to prevent the next Chipotle food safety crisis or Volkswagen environmental controversy. Do you have what it takes?